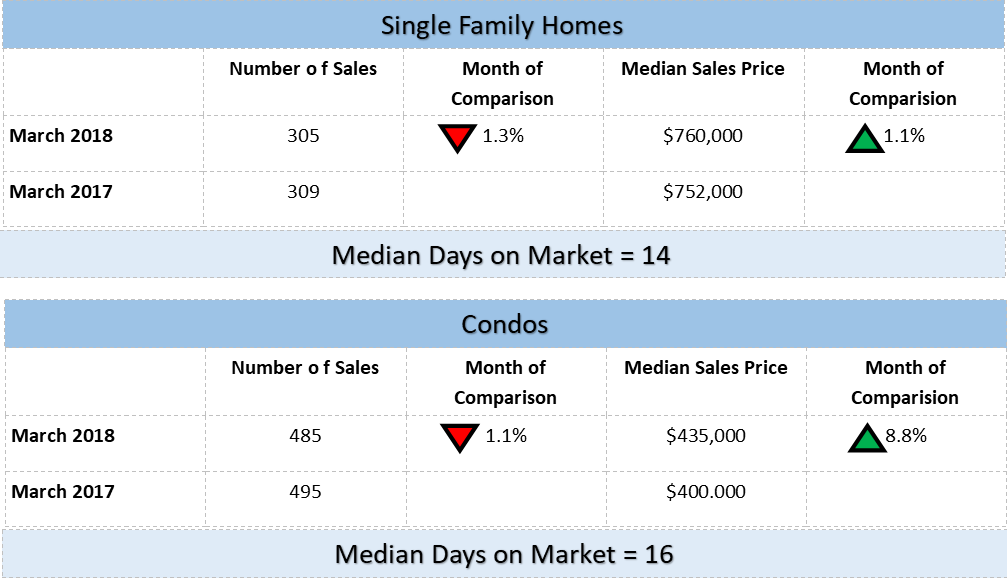

Rising interest rates and continued housing appreciation will impact future Hawaii home buyers ability to buy their dream home. As interest rates rise in 2018 through 2020 coupled with continuing appreciation of home values, buyer purchasing power will decrease. Hawaii Home Buyers need to take into consideration the impact of this decreased purchasing power and buy now if possible.

While some Hawaii Home Buyers are waiting on a hoped for market correction to decrease home prices, this is not the latest prediction by the National Association of Realtors (NAR) which is projecting homes will appreciate 3.1% in 2019 and 2.7% in 2020. This is after a 4.7% expected appreciation in in 2018.

As of October 2018 on the island of Oahu, the median sales price for a single family home (SFH) was $800,000 according to the Honolulu Board of Realtors. With NAR’s predicted appreciation the median sales price will increase to $824,800 in 2019 and 847,000 in 2020.

If this was the only factor impacting purchasing power, it might be manageable for some home buyers but with the predicted interest rate increases buyers are getting a double whammy. One more interest rate hike is expected in December 2018, two to three interest rate hikes are expected in 2019, and at least one hike in 2020. With the current rate being approximately 4.83% let’s estimate that with the final increase projected in 2018 and then two more next year the interest rate at the end of 2019 will potentially be 5.58%. Add one more projected increase in 2020 and the rate would be at 5.83%.

Below is a table that shows the impacts to Hawaii Home Buyers of the interest rate hikes and expected home owner appreciation.

|

2018 |

2019 |

2020 |

| Median Sales Price for SFH on Oahu |

$800,000 |

$824,800 |

$847,000 |

| Expected Home appreciation |

|

3.1% |

2.7% |

| Loan at 80% of value |

640,000 |

659,840 |

677,600 |

| Interest Rate* |

4.83% |

5.58% |

5.83% |

| Monthly Payment |

$3,402 |

$3,817 |

$4,028 |

| Annual Payment |

40,830 |

45,802 |

48,335 |

| Total Payments over 30 year mortgage |

$1,224,889 |

$1,374,073 |

$1,450,044 |

| Total Interest Paid over life of loan |

$584,889 |

$714,233 |

$772,444 |

*interest rate increase predictions were from CNBC article https://www.cnbc.com/2018/11/08/fed-leaves-rates-unchanged.html

What the chart above indicates is that if Hawaii Home Buyers were to wait to buy the same house in 2019 verses 2018, total payments will be $154,134 (interest and appreciation) more and in 2020 the increase will be $234,545. So yes. Now is a good time to buy.

Welcome to Our Blog Page

Welcome to Our Blog Page